A subsidized loan is a type of loan for undergraduate students with financial needs. You are not required to pay interest while in school with a subsidized loan from the Federal. What is the grace period for student loans?įor most Federal student loans, you have a grace period of six months after graduation, leave school, or drop below half-time enrollment to start repaying the student loan.ĭo you have to pay interest for student loans while in school? Paying while you are still studying is a good way to keep your loan balance low.

Fortunately, you can start paying for your student loan while you are still in school. By the time you graduated, the loan balance would have increased. Most student loans start accruing interest while you are in school with the exception of Federal subsidized loans. There are many types of student loans, some are sponsored by the Federal government, and others are from private lenders. You can start paying interest while you are in school or you can wait until you graduate from college.

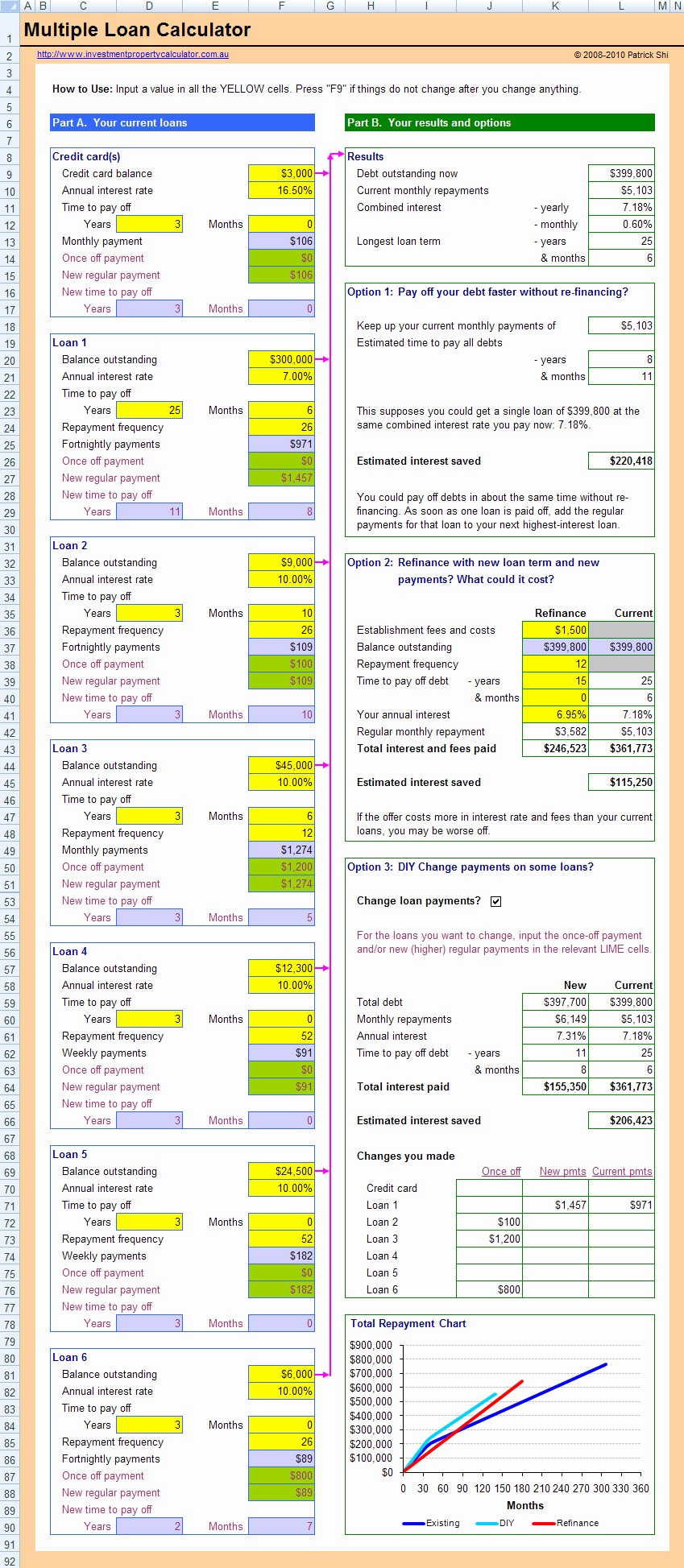

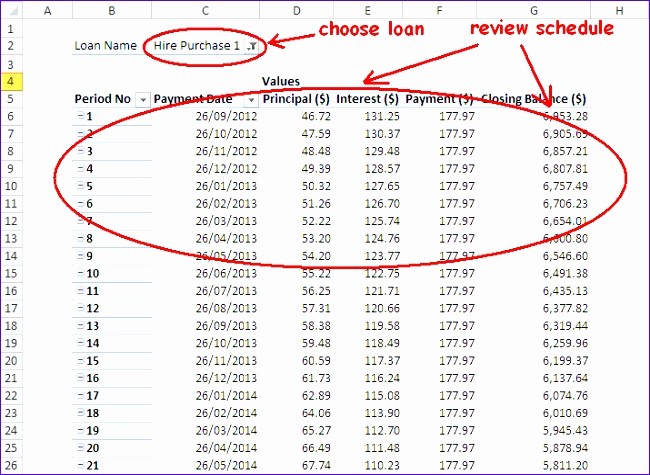

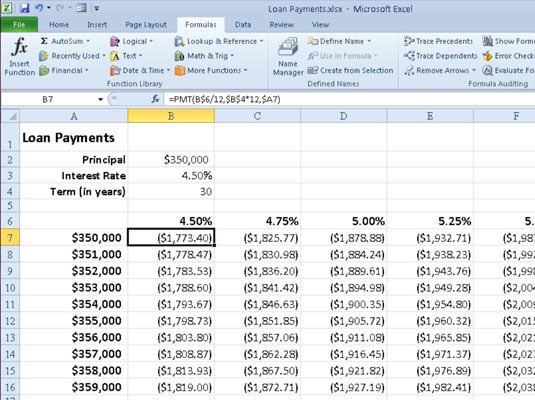

Like any other loan, student loans need to be paid back with interest. Student loans from the Federal government have the lowest interest rate and other benefits that other lenders don't offer. Student loans can come from the Federal government, banks, or other private financial institutions. You can use a student loan to pay for tuition, textbooks, computers, rent, or any other associated costs. This table helps you to understand the repayment schedule and plan your finances accordingly.A student loan is a loan granted to a student to cover the cost of going to college. The EMI calculator also provides an amortization table that shows the breakup of the EMI payment into principal and interest components for each year/month of the loan tenure. As the loan tenure progresses, the interest component reduces and the principal component increases. Initially, a major portion of the EMI payment goes towards paying the interest, and a smaller portion goes towards repaying the principal. The EMI calculation is based on the reducing balance method, which means that the interest is charged on the outstanding balance of the loan after each payment is made. The EMI calculator takes into account the principal loan amount, the interest rate, and the loan tenure to calculate the monthly payments.

An Education Loan EMI Calculator is a financial tool that helps you to calculate your monthly payments towards your education loan.

0 kommentar(er)

0 kommentar(er)